Is Canada in a recession? The data says we’re teetering on the brink.

It’s safe to say none of us saw this mess coming. Who knew when Canadian grizzly bears went to sleep last fall amidst a concerned buzz over how the U.S. election would turn out, they would wake up in the spring to threats of annexation, a global trade war, plunging stock portfolios and a federal election with one of the highest voter turnouts in recent history?After all the economic and political turmoil of the past few months, it’s easy to wonder if we’ve entered full-blown recession territory,

notes. But are we in a recession? Here’s what the data says.

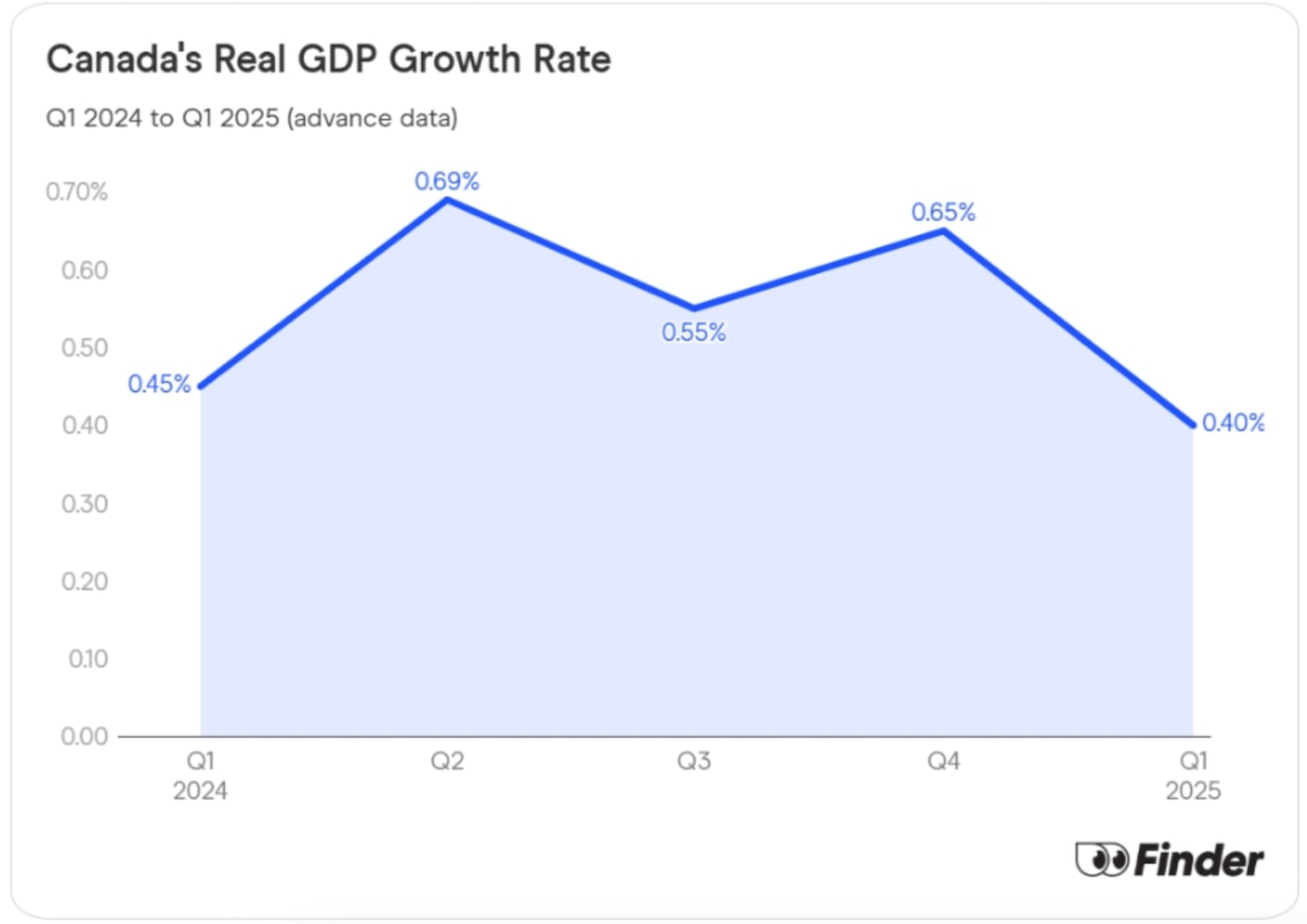

Canada’s GDP is declining

Early data suggests that Canada’s real GDP growth went down in Q1 2025, but this does not (yet) indicate a recession as real GDP growth was up the previous quarter.

The most common recession indicator is falling gross domestic product (GDP). This means a country’s rate of producing goods and services has slowed down—a pretty sure sign that businesses and people have fallen on hard times.The rule of thumb is that a country is in a recession when it has had two back-to-back quarters of negative real GDP growth. Basically, we’re in trouble if GDP growth (adjusted for inflation) slows down for the second quarter in a row.

that Canada’s real GDP growth went down by 0.15% in the first quarter of 2025 from 0.65% to 0.4%. That’s not good, but

the previous quarter, so the slump hasn’t lasted long enough to officially declare a recession in Canada.

Finder.com

Consumer spending is sending mixed signals

Declines in some discretionary spending categories and weakened consumer confidence may point to a recession, but recently boosted durable goods spending and retails sales do not.

Canada’s GDP doesn’t tell the whole story. Consumer spending and financial sentiment can also signal a market downturn. So, what are our wallets telling us?Looks like the message is “batten down the hatches.”Consumer spending has gone down so far in 2025,

. But that’s just the bigger picture. Looking at individual spending categories under a microscope, it’s more nuanced.

- Some (but not all) discretionary spending is down. Discretionary goods like luxury apparel and travel are down this year, with the exception of cars. But spending on discretionary services like restaurants and streaming is holding steady.

- Durable goods have picked up. Manufacturing has gotten a shot in the arm thanks to a boost in cross-border spending ahead of tariff implementation, particularly in vehicle sales.

- Retail sales are up following a recent dip. Overall, retail sales dropped in January and February but picked up in March. This could be seen as following a predictable pattern of sluggish post-holiday spending, but it's difficult to imagine that Trump-fueled financial uncertainty and pre-tariff spending don't play a role.

- Debt and delinquencies are problematic but may be improving. TransUnion reported in Q4 2024 that debt and delinquency levels in Canada were rising, but in March, Canadians reported quarter-over-quarter improvements in their insolvency and debt levels, which may be partially due to Bank of Canada rate cuts.

- Consumer sentiment is down. In January, more than 2 in 3 Canadians reported being moderately, very or extremely confident about their financial futures. An equal number (30%) claimed their financial situations had improved over the past year as those who claimed it had weakened. However, fast forward to April, and 1 in 3 Canadians expect their financial situations to worsen in the coming year.

Falling consumer sentiment and (somewhat) cautious spending make it feel like Canada is in a recession, but gains across some sectors plus sporadic, reactionary bumps in market activity make it tough to call the current environment a recession.

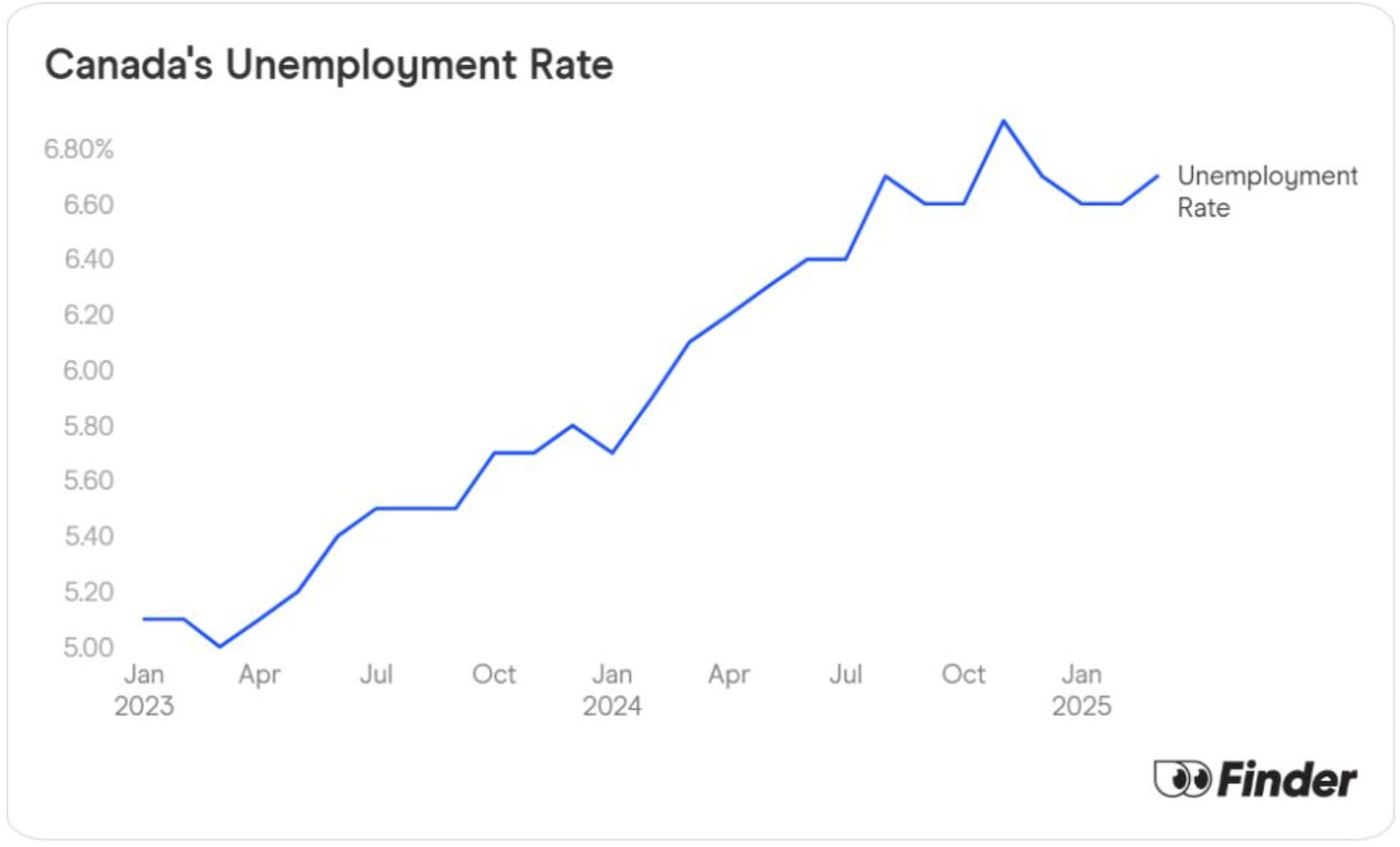

Unemployment is under recession levels—for now

The 3-month average unemployment rate in Canada does not indicate a recession.

Many businesses tighten their belts during economic downturns, leading to job cuts. But a month or two of heightened unemployment isn’t enough to raise a red flag.The Sahm rule is a commonly used reference in the U.S. for deciding if unemployment has peaked into a recession. According to the rule, you might be living in a recession if the 3-month average unemployment rate is at least 0.5% above the 12-month low. In Canada, the threshold is actually 0.6%.Over the past 12 months, the lowest

was 6.2% in April 2024. The average unemployment rate for January, February and March of this year is 6.6%—or 0.4% higher than the 12-month low. (April data isn’t available yet.)Based on these numbers, Canada’s unemployment rate does not place us in recession territory.It’s worth noting, though, that the story was different a couple of months ago. Based on data available in February, the 3-month average unemployment rate was 6.7%—or 1% higher than the 12-month low of 5.7% in January 2024. That’s enough to bring a tear to Sahm’s eye.

Finder.com

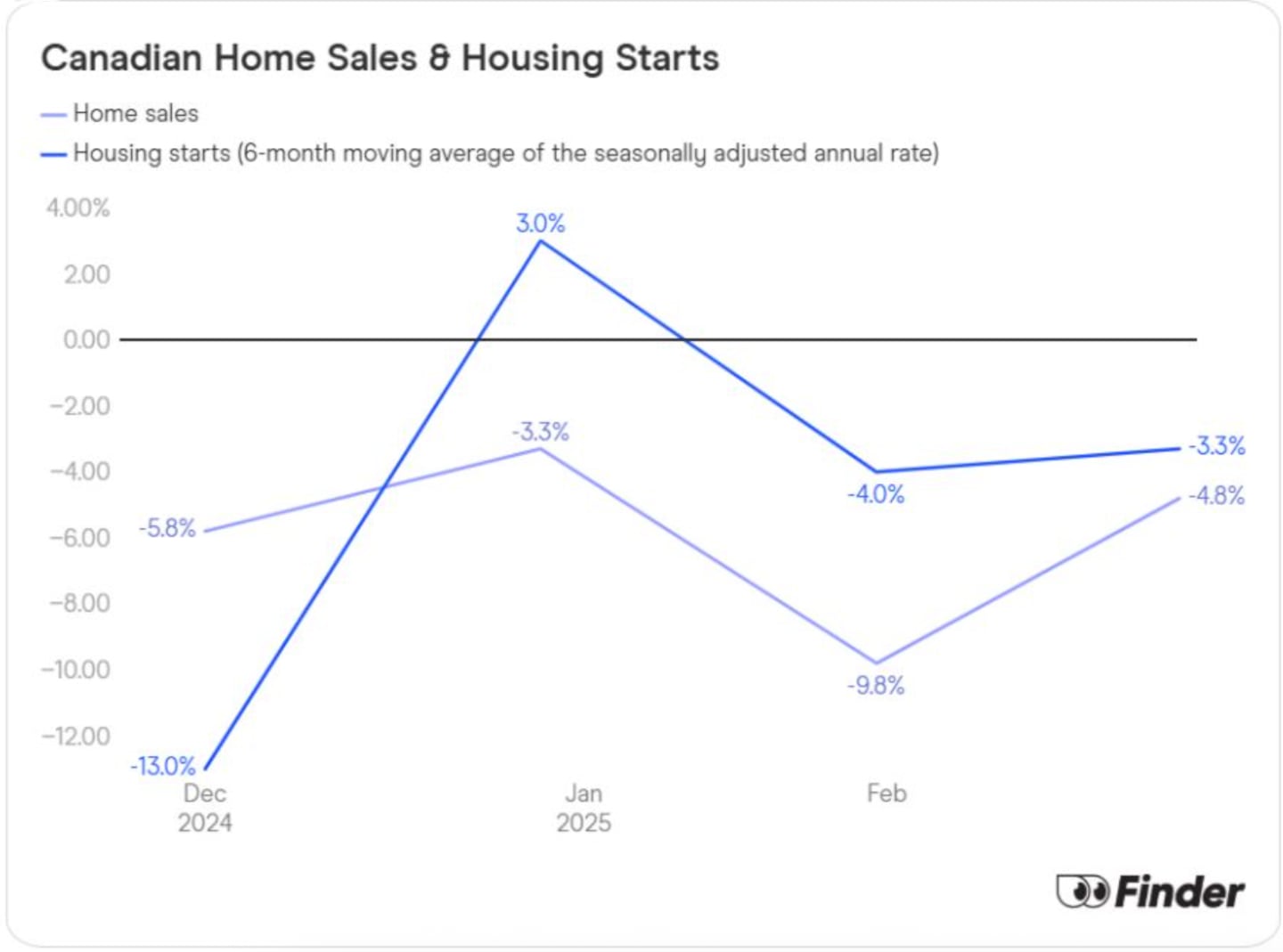

Housing market growth is slowing down

Home sales and residential building projects have declined this year in Canada, which may indicate a recession.Unsurprisingly, a country bracing itself for economic headwinds isn’t particularly bullish on shelling out for new homes.Home sales are down this quarter, with the

reporting a 4.8% month-over-month decline in March alone. Residential building projects also saw a 3.3% MoM decline in

following a 4% MoM decline in

.This trend isn’t reflected across the entire country as some regions grow or decline more than others, but overall, Canadians seem pensive about jumping into the real estate market—or many people simply can’t afford it.However, recent Bank of Canada rate cuts have improved home affordability. Additionally, newly elected Prime Minister Mark Carney has proposed a number of measures for making home ownership more accessible to Canadians, including doubling the rate of residential construction over the next 10 years and cutting GST for first-time buyers who purchase newly built homes.Change can’t come fast enough for the real estate industry in Canada. As it stands right now, the housing market is out in the cold and might just get the flu.

Finder.com

What’s the bottom line?

Is Canada in a recession? Right now, no. But that doesn’t mean we’re out of the woods. Early data suggests GDP growth was negative in the first quarter of 2025—another quarter of negative growth and you might start hearing recession sirens blaring.Other signs of a marked economic slowdown include declining consumer sentiment and reduced spending on unnecessary and big-ticket items, although tariff threats have recently boosted cross-border sales. Thankfully, the unemployment rate is currently below recession levels, but negative MoM growth in home sales and housing starts make it impossible to ignore the real possibility of a Canadian recession in the near future.

Be smart and prepare your finances

Worried you might lose when the next economic tide hits? Follow these time-tested tips for staying grounded in the midst of financial uncertainty:

- Build up emergency savings. Finder.com reports that more than 40% of Canadians would pay for an unexpected $1,000 expense with disposable income or credit cards. Don't be one of them. Skip eating out, replace costly fun with free activities and do whatever you have to do to stash away for emergencies.

- Cut costs and pay down debt. While you're at it, why not slash spending even more aggressively to pay off debt? Going the extra mile now could relieve you in the future if the current economic squeeze continues. Also, think twice about going into debt to pay for large purchases until your financial outlook is more assured.

- Increase your income. Look for ways to put more money in your pocket. Can you make a side hustle out of any hobbies or interests? Is it possible to leverage any special skills to get some freelance work?

- Reevaluate your investments. It's always a good idea to keep an eye on your saving and investment plans and make adjustments as necessary—even more so when the stock market makes a hairpin turn and the economy takes a tumble. Keep in mind capital preservation and your risk tolerance, and don't make decisions based purely on emotion.

was produced by

and reviewed and distributed by

.